capital gains tax proposal canada

Capital Gains Tax Rate In Canada 50 of the value of any capital gains are taxable. In other words if you sell an investment at a higher price than you paid realized capital gains youll have to add 50 of the capital gains to your income.

Daily Banking Awareness 06 December 2019 Awareness Financial Banking

A federal NDP campaign promise to increase the capital gains inclusion rate to 75 from 50 would bring in 447 billion over the next five years according to estimates released by the Parliamentary Budget Office.

. And the tax rate depends on your income. Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972. The Presidents proposal moves capital gains taxation in the United States directly toward how weve done it in Canada for the last 40 years.

Increasing the top capital gains rate for people with an annual income of more than US1-million to 396 per cent from 20 per cent. In Canada taxpayers are liable for paying income taxes on 50 of the value of their capital gains in a given year. You may have to report a capital gain if you change your principal residence to a rental or business property or vice versa.

When the tax was first introduced to Canada the inclusion rate was 50. This increased to 75 in 1990 and was then reduced back to 50 in 2000 where it has remained for the last 20 years. When Is a Capital Gain Subject to Tax.

This is consistent with the measures announced in Budget 2021. The age amount has been increased to. The proposal includes raising the top marginal rate to 35 for Canadians earning more than 216511 this year.

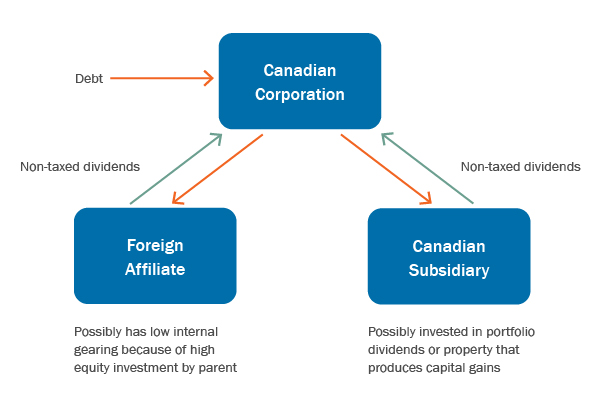

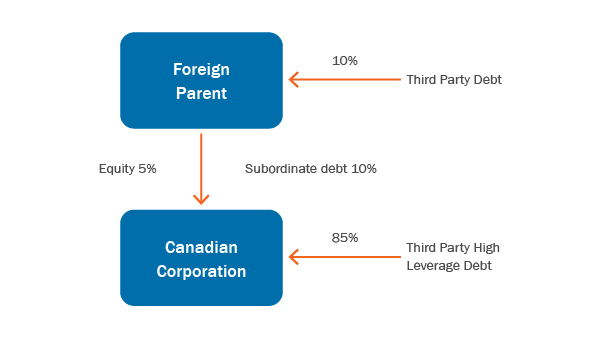

Defined in the Proposals as ratio of permissible expenses the fixed ratio would be 30. Capital gains tax on home sales a risky proposal experts say by brett bundale the canadian press posted september 10 2021 514 pm This has canada speculating again if a hike to the capital Over the last year there has been considerable speculation like most other things these days about the federal government increasing the inclusion. Capital gains tax is calculated as follows.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large corporations. Capital gains tax in Canada In Canada 50 of the value of any capital gains is taxable.

Sale of farm property that includes a principal residence Only part of your capital gain may be taxable. Tashapb I Will File Your Uk Company Accounts And Tax Return For 110 On Fiverr Com Tax Consulting Corporate Accounting Filing Taxes. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province.

The inclusion rate for personal and business income is 100 meaning you need to pay taxes on all of your income. The recent passage of Bill C-208 exacerbates these issues. For purposes of transition a higher fixed ratio of 40 would apply for taxation years beginning on or after January 1 2023 and before January 1 2024.

Capital gains tax proposal canada Saturday May 28 2022 Edit The tax would apply to corporations that earned more than 10 million in revenues in at least one year between 2016 and 2020. One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an equivalent fair market. This means that you must take half of whatever you made in capital gains add that amount to your income and then subject that total income amount to income tax.

None of the plans put forward by Canadas main parties suggest lifting the capital gains exemption for principal residences with the exception of the Liberal partys proposed anti-flipping tax. Profits made on a primary residence above 250000 500000 for couples is subject to a capital gains rate. A higher luxury goods tax is also on the.

The current capital gains tax preferences cost 35 billion annually with high-income families accruing most of the benefit. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income. To fix these problems the inclusion rate for capital gains should rise.

NDPs proto-platform calls for levying higher taxes on the ultra-rich and large corporations. Selling a building Special rules may apply if you sold a building for less than its cost amount and its capital cost. For a Canadian who falls in a 33 marginal tax bracket the.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. The party released the PBOs costing of its campaign platform on Saturday. The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return.

On a capital gain of 50000 for instance only half of that amount 25000 is taxable. The proposal includes raising the top marginal rate to 35 for Canadians earning more than 216511 this year.

This Week In Coins Prices Continue Downward Central African Republic Adopts Bitcoin Canada Says Nah Wa In 2022 Central African Republic Central African Republic

Pin By Canada Immigration Guide On Http Canadaimmigrationpath Com How To Apply Permanent Residence Instruction

Highlights Of Draft Tax Legislation To Implement Certain Budget 2021 Measures Insights Torys Llp

Irs Tax Forms Form 1040 Schedule C Schedule E And K 1 For Business Irs Tax Forms Irs Taxes Tax Forms

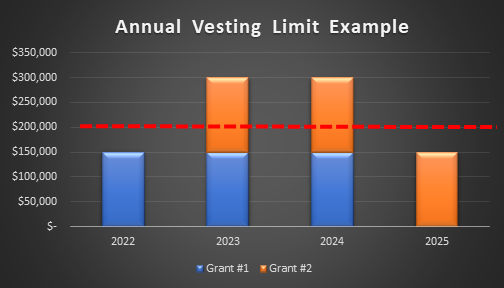

Canada Proposed Changes To Taxation Of Employee Stock Options Now Law Ey Global

Canada Tax Income Taxes In Canada Tax Foundation

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Challenging Books In Library Study To Rise In 2021 In 2022 Books History Lessons Education Reform

Wealth Tax Would Make Canada S Bad Situation Even Worse Fraser Institute

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

High Income Earners Need Specialized Advice Investment Executive

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Highlights Of Draft Tax Legislation To Implement Certain Budget 2021 Measures Insights Torys Llp